The Debit Card Fraud Mistake That Could Cost You Up To $500 | Br…

Q&A with Organizational Pro Peter Walsh + Dermatologist Shares A…

Actor Hank Azaria + Freezer Meals + Artichokes 2 Ways with Rach

See Inside Barbara Corcoran's Stunning NY Apartment + It's Steak…

How to Make Chicken and Lobster Piccata | Richard Blais

Donnie Wahlberg Spills Details About NKOTB's First Ever Conventi…

Donnie Wahlberg + Jenny McCarthy Say Rach Is Such a "Joy" + Look…

The Best Moments From 17 Seasons of the Show Will Make You Laugh…

How to Make Crabby Carbonara | Rachael Ray

Rach Chats "Firsts" In Flashback From Our First Episode Ever In …

How to Make Apple-Cider Braised Pork Chop Sandwiches with Onion …

Rach's Chef Pals Say Goodbye to Show in Surprise Video Message

How to Make Sesame Cookies | Buddy Valastro

How to Make Tortilla with Potatoes, Piquillo Peppers and Mancheg…

How to Make Shrimp Burgers | Jacques Pepin

How to Make Spanakopipasta | Rachael Ray

Andrew McCarthy Chokes Up Discussing Emotional Trip to Spain wit…

Celebrity Guests Send Farewell Messages After 17 Seasons of the …

Celebrity Guests Send Farewell Messages After 17 Seasons of the …

Andrew McCarthy Teases Upcoming "Brat Pack" Reunion Special

Michelle Obama Toasts Rach's 17 Years on the Air With a Heartfel…

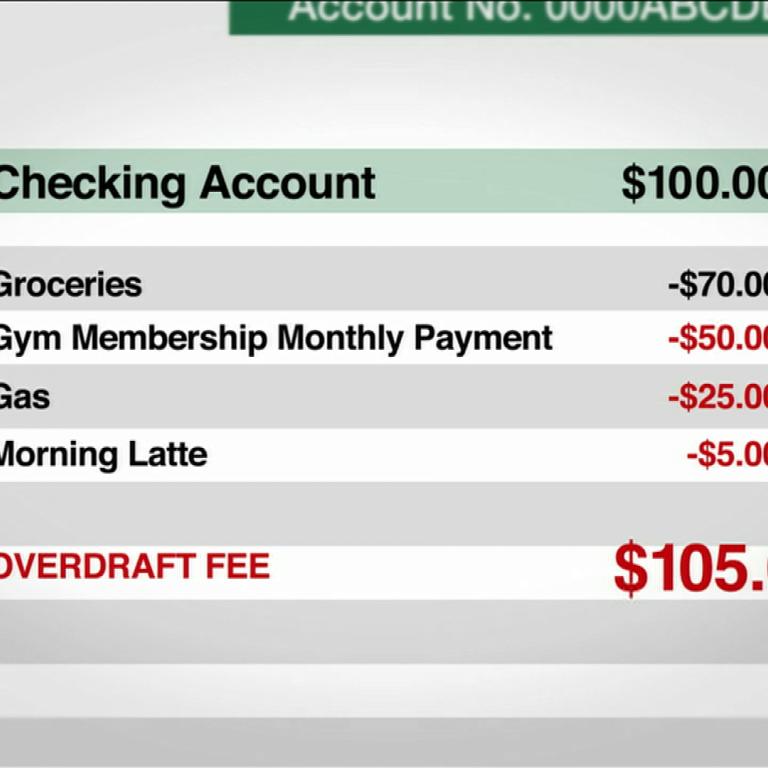

When it comes to personal finance, there are a number of reasons why you should be monitoring all of your bank accounts closely. In addition to tracking your spending so you can set a budget and save more money, you want to keep an eye out for extra fees from your bank as well as any suspicious charges.

Catching fraudulent activity on your account is important so you can take action, of course, but did you know that you can actually be charged up to $500 if you don't notify your bank almost immediately? Erin Lowry, personal finance expert and author of Broke Millennial: Stop Scraping By and Get Your Financial Life Together, has all the info you should know.

First off, if you realize your debit card has been lost or stolen, freeze your account and notify your bank or credit union right away. If you notify your bank of a lost or stolen debit card before any charges occur, you should not be liable for any charges.

If you do find fraud on your debit card, you need to notify your bank immediately in order to be refunded. Notifying of fraudulent activity within 48 hours usually limits your losses to $50 or less, according to Erin.

"You have about 48 hours—2 business days—to let them know, otherwise you could be liable for [up to] $500 of those fraudulent charges," she says. "And then after that, if you wait more than 60 days you could be liable for all [unauthorized charges]," Erin continues. It's best to check your bank's specific policy, too.

Erin stresses the importance of setting up alerts through your banking app so that you are notified about every debit card charge. That way, you'll know immediately if fraud occurs and can take the necessary steps so you aren't liable for the charges.