How Lawyer-Turned-Instagram Star Cindy Zuniga Paid Off $215K of …

Q&A with Organizational Pro Peter Walsh + Dermatologist Shares A…

Actor Hank Azaria + Freezer Meals + Artichokes 2 Ways with Rach

See Inside Barbara Corcoran's Stunning NY Apartment + It's Steak…

How to Make Chicken and Lobster Piccata | Richard Blais

Donnie Wahlberg Spills Details About NKOTB's First Ever Conventi…

Donnie Wahlberg + Jenny McCarthy Say Rach Is Such a "Joy" + Look…

The Best Moments From 17 Seasons of the Show Will Make You Laugh…

How to Make Crabby Carbonara | Rachael Ray

Rach Chats "Firsts" In Flashback From Our First Episode Ever In …

How to Make Apple-Cider Braised Pork Chop Sandwiches with Onion …

Rach's Chef Pals Say Goodbye to Show in Surprise Video Message

How to Make Sesame Cookies | Buddy Valastro

How to Make Tortilla with Potatoes, Piquillo Peppers and Mancheg…

How to Make Shrimp Burgers | Jacques Pepin

How to Make Spanakopipasta | Rachael Ray

Andrew McCarthy Chokes Up Discussing Emotional Trip to Spain wit…

Celebrity Guests Send Farewell Messages After 17 Seasons of the …

Celebrity Guests Send Farewell Messages After 17 Seasons of the …

Andrew McCarthy Teases Upcoming "Brat Pack" Reunion Special

Michelle Obama Toasts Rach's 17 Years on the Air With a Heartfel…

Cindy Zuniga is the lawyer behind the hit budget-focused Instagram page @ZeroBasedBudget and blog, and her claim to fame is inspirational to say the least: She paid off her $215,000 worth of debt in just 48 months.

Yes, you read that right. Four years! Amazing, right?

“I graduated from law school in 2015 with over $200,000 of student loan debt and $13,000 of credit card debt,” she says.

Like lots of post-grads, she deferred the loan for one year, then started paying it back. But after one year of payments, she realized something staggering: Even though she made payments worth $24,000, only $4,000 went towards the principal. The other $20,000 went towards the interest!

Horrified, Cindy made a smart decision — she decided to refinance her loan, a choice, she says, that ended up saving her a whopping $40,000.

(So, for those taking notes, that’s tip #1 for you!)

With the new lender, she also had a new payment amount — higher than before, but she wanted that, to try to pay off the loan as quickly as possible.

And indeed, she did pay it off in record time! But she did it more than just for herself — she did it so that she could start helping her family, specifically her immigrant parents.

“My ‘why’ [for paying off my loans] is my family,” Cindy explains. “My parents are immigrants — they immigrated to this country in the early ‘70s — and I knew that I wanted to be able to help them, for all the sacrifices they made for me and my sisters.”

(Tissue, please!)

She admits, “This was not an easy process, but I’m so glad I did it. I’m 100% debt-free, and I’m really proud of myself.”

As she should be! But how did she do it? By employing what she calls a “zero-based budget.”

WHAT IS A ZERO-BASED BUDGET?

“The zero-based budget,” Cindy explains, “is a budgeting system in which you allocate every single dollar that comes in to a specific category.”

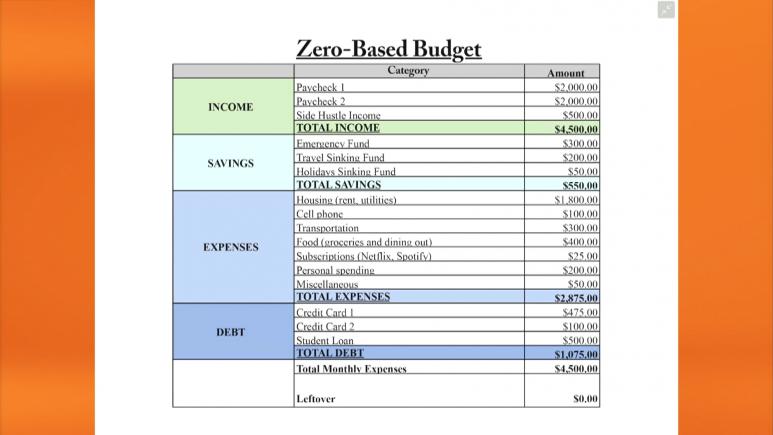

As you can see in the chart above, Cindy maintained a sheet that listed her income, savings, expenses, and debt. Her paychecks went into the income category, which told her just how much she had to send to the other three categories. Every dollar was allocated, so that in the end, there were zero dollars left (hence the name of the budget and her social handle, which is 30K+ followers strong).

And yes, the name sounds a little scary! But there’s no need to be spooked, because, as Cindy explained to us (using the chart above), it’s not that you never have any extra money so much as luxuries big and small are budgeted for in advance, in what she calls her “sinking funds.”

WHAT ARE SINKING FUNDS?

For instance, she explains, if you like to travel (she does, too!), then you’ll want to set up a travel sinking fund, which will help you save up for your next trip (or your next television, or your next spa day, it’s up to you!).

Here’s the equation Cindy uses to help her know what to put in each sinking fund:

How much money is needed / How many months out you are = How much you need to put in the sinking fund each month

This way, when it’s time to pay for whatever you’re saving up for, you won’t have to add it to your credit card debt. You can just pull it right out of the sinking fund you set up specifically for it.

Pretty great, right?

Just make sure to think of everything you’ll need! For instance, for a trip, you might need flights, hotel, money for food, money for transportation and money for souvenirs — and that all adds up. Be honest with yourself up front, and you’ll be a LOT happier in the long run!