How To Calculate DTI (Debt-To-Income Ratio) | Broke Millennial A…

Q&A with Organizational Pro Peter Walsh + Dermatologist Shares A…

Actor Hank Azaria + Freezer Meals + Artichokes 2 Ways with Rach

See Inside Barbara Corcoran's Stunning NY Apartment + It's Steak…

How to Make Chicken and Lobster Piccata | Richard Blais

Donnie Wahlberg Spills Details About NKOTB's First Ever Conventi…

Donnie Wahlberg + Jenny McCarthy Say Rach Is Such a "Joy" + Look…

The Best Moments From 17 Seasons of the Show Will Make You Laugh…

How to Make Crabby Carbonara | Rachael Ray

Rach Chats "Firsts" In Flashback From Our First Episode Ever In …

How to Make Apple-Cider Braised Pork Chop Sandwiches with Onion …

Rach's Chef Pals Say Goodbye to Show in Surprise Video Message

How to Make Sesame Cookies | Buddy Valastro

How to Make Tortilla with Potatoes, Piquillo Peppers and Mancheg…

How to Make Shrimp Burgers | Jacques Pepin

How to Make Spanakopipasta | Rachael Ray

Andrew McCarthy Chokes Up Discussing Emotional Trip to Spain wit…

Celebrity Guests Send Farewell Messages After 17 Seasons of the …

Celebrity Guests Send Farewell Messages After 17 Seasons of the …

Andrew McCarthy Teases Upcoming "Brat Pack" Reunion Special

Michelle Obama Toasts Rach's 17 Years on the Air With a Heartfel…

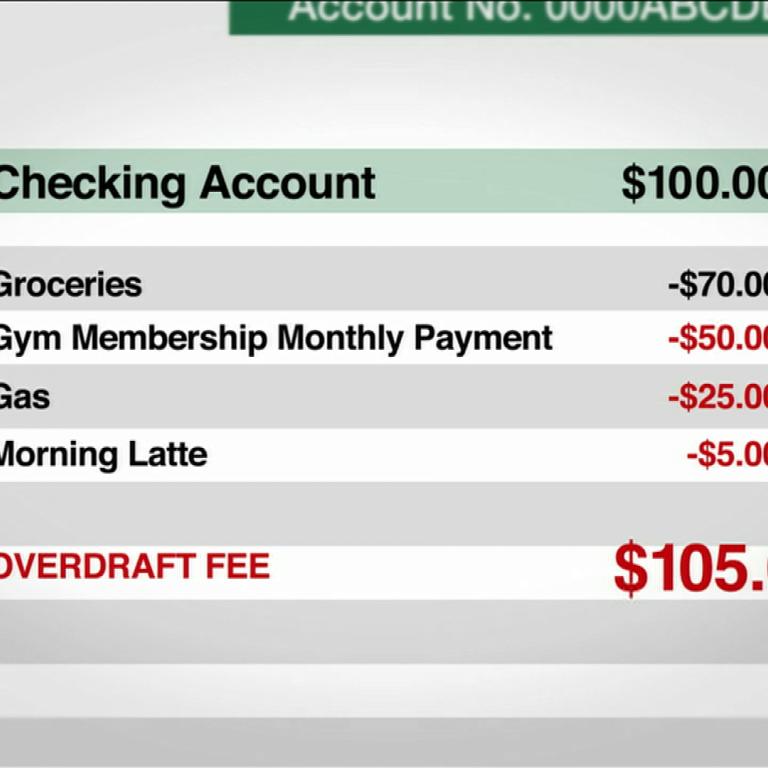

Everyone talks about the importance of your credit score — but your debt-to-income ratio (DTI) may be just as important, Broke Millennial: Stop Scraping by and Get your Financial Life Together author Erin Lowry says.

She explains why.

WHAT IS DEBT TO INCOME RATIO & WHY IS IT IMPORTANT?

"Why this matters is because it actually really gives you a sense of how much more debt, if any, you can handle," Erin explains.

In other words, DTI is a key factor lenders use to decide whether or not to give you a loan.

"Lenders care a lot about it," the personal finance expert says. "Of course your credit score is important, but this is important, too."

HOW TO CALCULATE DTI

Debt-to-income ratio (DTI) = (Monthly debt / Monthly gross income) x 100

Let's break that down.

Monthly debt: "It's not your total debt," the Broke Millennial author says. It's student loans, car loans, your mortgage, or balances on credit cards that you're paying off in monthly installments.

Monthly gross income: Your monthly income before taxes, healthcare costs and retirement contributions are taken into account.

WHAT IS A GOOD DTI?

"If it comes out at 20% or less, you're doing pretty well. It's kind of like having a 700 credit score. You're looking good. If you're at 40% or higher, it might be a little bit of a red flag."