Overdraft Fees & Transaction Reordering Explained | Broke Millen…

Q&A with Organizational Pro Peter Walsh + Dermatologist Shares A…

Actor Hank Azaria + Freezer Meals + Artichokes 2 Ways with Rach

See Inside Barbara Corcoran's Stunning NY Apartment + It's Steak…

How to Make Chicken and Lobster Piccata | Richard Blais

Donnie Wahlberg Spills Details About NKOTB's First Ever Conventi…

Donnie Wahlberg + Jenny McCarthy Say Rach Is Such a "Joy" + Look…

The Best Moments From 17 Seasons of the Show Will Make You Laugh…

How to Make Crabby Carbonara | Rachael Ray

Rach Chats "Firsts" In Flashback From Our First Episode Ever In …

How to Make Apple-Cider Braised Pork Chop Sandwiches with Onion …

Rach's Chef Pals Say Goodbye to Show in Surprise Video Message

How to Make Sesame Cookies | Buddy Valastro

How to Make Tortilla with Potatoes, Piquillo Peppers and Mancheg…

How to Make Shrimp Burgers | Jacques Pepin

How to Make Spanakopipasta | Rachael Ray

Andrew McCarthy Chokes Up Discussing Emotional Trip to Spain wit…

Celebrity Guests Send Farewell Messages After 17 Seasons of the …

Celebrity Guests Send Farewell Messages After 17 Seasons of the …

Andrew McCarthy Teases Upcoming "Brat Pack" Reunion Special

Michelle Obama Toasts Rach's 17 Years on the Air With a Heartfel…

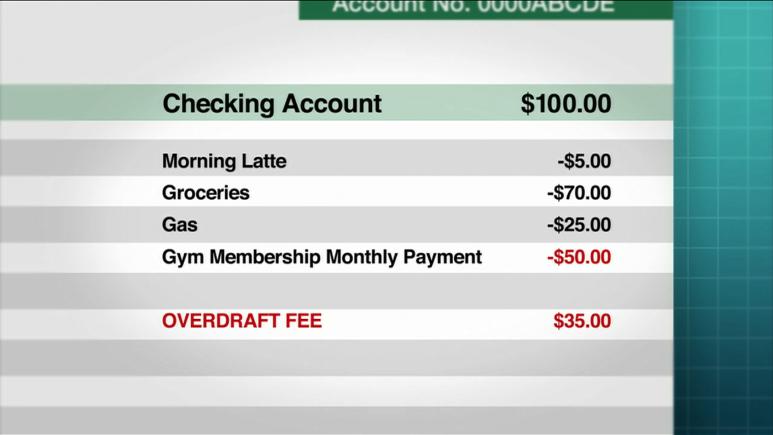

If you use a debit card, you're probably familiar with pesky overdraft fees. Here's an example from Erin Lowry, personal finance expert and author of Broke Millennial: Stop Scraping By and Get Your Financial Life Together:

You start the day with $100 left in your checking account. You buy your $5 morning latte, then spend $70 on groceries and $25 on gas. "You're getting paid tomorrow, you're not concerned. But you forgot that your gym membership [monthly payment] hits today and that's $50. So boom, you've gone overdraft," Erin says. "Now typically that's a one time fee of $35, but what can happen is the bank can actually change the order [of your transactions] from chronological to largest to smallest."

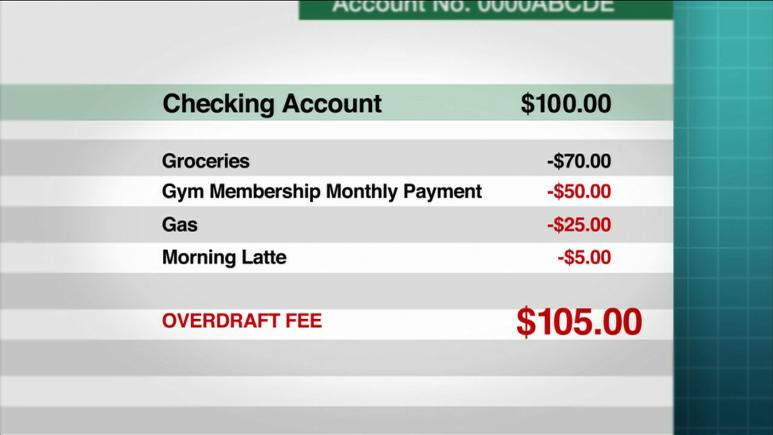

Now your statement says you bought groceries first, then your gym membership hit — that's the first overdraft. Then you bought your gas — 2nd overdraft, and finally bought the $5 latte — third overdraft. So now that's $105 in overdraft fees versus $35.

This is called transaction reordering, and it's a practice some banks engage in that can lead to additional overdraft fees, Erin explains. "Technically under federal law it is legal. Your state might regulate it, but it is technically legal," the personal finance expert says.

What can you do about transaction reordering?

The first step is to get into the habit of checking your card statements regularly, meaning daily or weekly. You can set up alerts through your banking app to get texts or emails regularly about your current balance and even anytime you make a transaction. Not only will this help you track your spending, but it can help you be aware of things that need to be taken care of ASAP, like transaction reordering, Erin says.

RELATED: 4 Steps To Organizing Your Finances Like a Millennial

If you are charged extra fees due to transaction reordering, call your bank and see if you can get the fees reversed.

And finally, do your research so you can prevent this from happening in the future. Bank computer systems may be designed to process checks randomly, from the largest to the smallest check amount, assuming that larger checks are the most important payments being made by the customer. Ask your bank which method it uses to post checks. Then, "shop around, see if maybe there's another bank that doesn't do that," Erin advises.