Dr. Drew Gives Advice To Couple That Can't Agree On Money

Q&A with Organizational Pro Peter Walsh + Dermatologist Shares A…

Actor Hank Azaria + Freezer Meals + Artichokes 2 Ways with Rach

See Inside Barbara Corcoran's Stunning NY Apartment + It's Steak…

How to Make Chicken and Lobster Piccata | Richard Blais

Donnie Wahlberg Spills Details About NKOTB's First Ever Conventi…

Donnie Wahlberg + Jenny McCarthy Say Rach Is Such a "Joy" + Look…

The Best Moments From 17 Seasons of the Show Will Make You Laugh…

How to Make Crabby Carbonara | Rachael Ray

Rach Chats "Firsts" In Flashback From Our First Episode Ever In …

How to Make Apple-Cider Braised Pork Chop Sandwiches with Onion …

Rach's Chef Pals Say Goodbye to Show in Surprise Video Message

How to Make Sesame Cookies | Buddy Valastro

How to Make Tortilla with Potatoes, Piquillo Peppers and Mancheg…

How to Make Shrimp Burgers | Jacques Pepin

How to Make Spanakopipasta | Rachael Ray

Andrew McCarthy Chokes Up Discussing Emotional Trip to Spain wit…

Celebrity Guests Send Farewell Messages After 17 Seasons of the …

Celebrity Guests Send Farewell Messages After 17 Seasons of the …

Andrew McCarthy Teases Upcoming "Brat Pack" Reunion Special

Michelle Obama Toasts Rach's 17 Years on the Air With a Heartfel…

Self-care is so important — but it's also important not to use the term as an excuse for practicing unhealthy habits. When your "retail therapy" starts affecting your marriage, for example, it might be time to take a step back and assess the situation.

"The idea of self-care can sometimes become a little destructive," board-certified internist and self-help expert Dr. Drew Pinsky explains. "It can also be defensive — in other words, 'Hey, I'm doing this compulsive thing because it's my self care.'"

Dr. Drew shared his expert advice with married couple and studio audience members Larry and Shameka, who are having trouble agreeing on how to budget their money.

The two have been married for 22 years, and have three kids (ages 23, 18 and 11). Larry is very frugal, while Shameka loves to shop. And while she says she usually shops the clearance rack, Larry thinks she goes out of her way to spend money on things they don't need. He would prefer to put some of that money away in a nest egg for their kids.

The expert shared some budgeting guidelines with the couple, encouraging them to group their expenditures as a family into three main categories.

"Every marriage has to reach its equilibrium, where you agree on certain things," Dr. Drew says. This includes deciding where to spend a little extra and when to save.

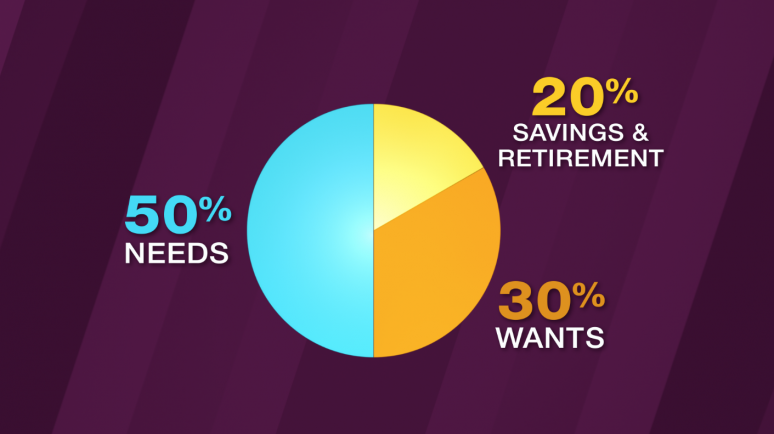

He recommends following the 50/20/30 rule when it comes to budgeting.

50% NEEDS

50% of your total monthly income should be budgeted for your needs, the doc says. This includes your mortgage, insurance and car payments, and any other bills you have to pay regularly.

RELATED: You May Be Cutting The Wrong Expenses To Save Money, According To a Financial Expert

20% SAVINGS AND RETIREMENT

It's recommended that you regularly budget 20% of your monthly income for savings and retirement, according to Dr. Drew.

30% WANTS

"Here's the 30% where you can have some fun," he says.

You can put 30% of your budget into wants — which can mean many different things. "It's not just the retail therapy — it's also you guys going to dinner, it's also taking the kids to amusement parks — it's things you don't need, but you want to do," Dr. Drew continues.

RELATED: Couple Shares Their 50 Before 50 Bucket List

This is where couples will have to do some compromising — but the first step is to agree to the budget, the doc stresses.